Are you wondering what full coverage car insurance really covers? You might think it protects you from everything, but the details matter a lot.

Understanding what’s included can save you from unexpected costs and stress later. You’ll discover exactly what full coverage means for your car, your wallet, and your peace of mind. Keep reading to learn how to make sure you’re fully protected without paying for extras you don’t need.

Basics Of Full Coverage

Full coverage car insurance offers more protection than basic policies. It helps cover different types of damage and loss. This insurance is important for drivers who want peace of mind on the road.

Many people confuse full coverage with a single type of insurance. In reality, it combines several coverages to protect you and your vehicle.

Components Included

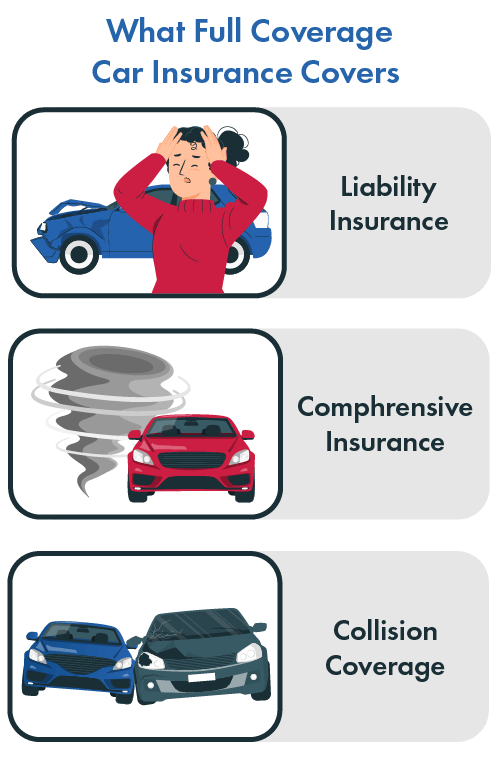

Full coverage car insurance usually includes several key parts. Each part covers specific risks and helps pay for damages or injuries.

- Liability insurance:Pays for damage or injury you cause to others.

- Collision coverage:Pays for damage to your car after a crash.

- Comprehensive coverage:Covers damage from theft, fire, or natural disasters.

- Medical payments:Helps pay medical bills for you and passengers.

- Uninsured motorist coverage:Protects you if an uninsured driver causes an accident.

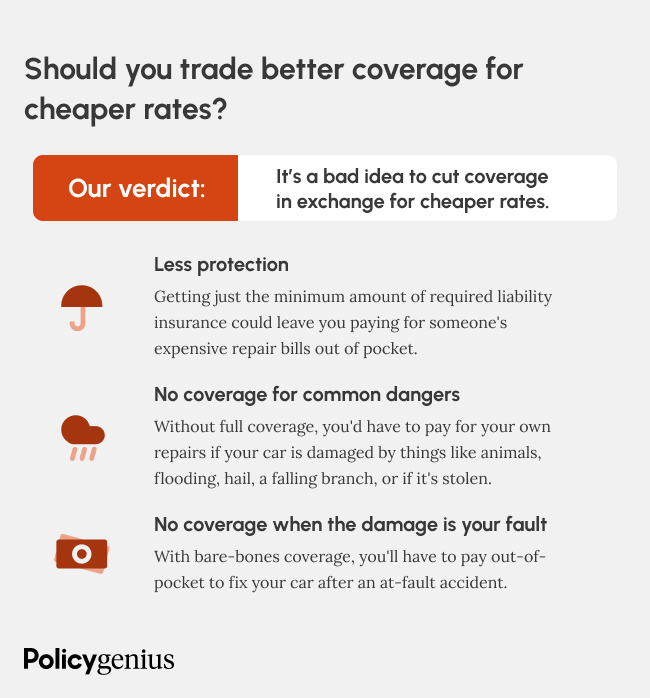

How It Differs From Minimum Coverage

Minimum coverage meets only legal requirements. Full coverage provides broader protection. The differences affect what costs you pay after an accident.

| Coverage Type | Minimum Coverage | Full Coverage |

|---|---|---|

| Liability | Required by law, limited amounts | Higher limits, covers more costs |

| Collision | Not included | Covers damage to your car |

| Comprehensive | Not included | Covers theft, weather, and more |

| Medical Payments | Sometimes included | Often included with better limits |

| Uninsured Motorist | Optional in some states | Usually included for full protection |

Credit: www.youtube.com

Liability Coverage Details

Liability coverage is a key part of full coverage car insurance. It helps pay for damage you cause to others. This includes injuries and property damage.

This coverage protects you if you are at fault in an accident. It covers costs that you must legally pay to others.

Bodily Injury Protection

Bodily injury protection helps pay for injuries you cause to other people. This includes medical bills and lost wages.

It also covers legal fees if the injured person sues you. This part of liability coverage keeps you from paying a lot out of pocket.

- Medical expenses for injured people

- Lost income due to injury

- Legal costs from injury lawsuits

Property Damage Protection

Property damage protection pays for damage you cause to someone else’s property. Usually, this means damage to another car.

This coverage also pays for damage to fences, buildings, or other property you hit. It helps cover repair or replacement costs.

- Repairs to other cars

- Fixing fences or buildings

- Replacing damaged property

Collision Coverage Explained

Collision coverage helps pay for damage to your car after an accident. It covers repairs or replacement if you hit another vehicle or object.

This type of insurance is important for protecting your vehicle from costly repairs after crashes. It works with your full coverage car insurance.

Accident Repairs

Collision coverage pays to fix your car after an accident. This includes damage from crashes with other cars or objects like trees or poles.

- Body damage such as dents and scratches

- Broken windows or mirrors

- Frame damage repair

- Replacing damaged parts like bumpers or lights

Deductibles And Limits

Collision insurance has a deductible you must pay before coverage starts. You also have coverage limits, which is the max amount the insurer will pay.

| Term | Meaning |

|---|---|

| Deductible | The amount you pay out of pocket before insurance pays |

| Coverage Limit | The maximum amount the insurance will pay for a claim |

| Claim | A request for insurance payment after an accident |

Credit: www.insurancenavy.com

Comprehensive Coverage Features

Full coverage car insurance often includes comprehensive coverage. This part protects your vehicle from damage not caused by collisions. It covers many risks that can affect your car.

Comprehensive coverage helps pay for repairs or replacement in cases like theft or weather damage. It gives peace of mind beyond basic accident protection.

Theft And Vandalism

Comprehensive coverage protects your car if it is stolen or damaged by vandals. This includes broken windows, scratches, or other intentional harm. It also covers loss from theft of parts or the entire vehicle.

- Car theft or attempted theft

- Damage from vandalism

- Broken windows or mirrors

- Theft of car parts or accessories

- Damage caused during a break-in

Natural Disasters And Weather Damage

Comprehensive coverage also protects your car from many natural events. This includes damage from storms, floods, and other weather conditions. It helps cover repairs caused by these incidents.

| Type of Damage | Examples |

| Storm Damage | Hail, falling trees, wind damage |

| Flood Damage | Water damage from heavy rain or floods |

| Fire Damage | Damage caused by wildfires or vehicle fire |

| Other Weather Damage | Snow, ice, or lightning strikes |

Additional Full Coverage Benefits

Full coverage car insurance offers more than just damage protection for your vehicle. It includes benefits that cover medical costs and protect you from uninsured drivers.

These extra benefits help you stay safe and reduce financial risks after an accident. Below are key parts of these additional coverages.

Medical Payments Coverage

Medical Payments Coverage pays for medical bills after an accident. It covers you and your passengers, no matter who caused the crash.

- Doctor visits and hospital stays

- Emergency room services

- Medical testing and treatments

- Funeral expenses in case of death

Uninsured Motorist Protection

Uninsured Motorist Protection helps if you get hit by a driver without insurance or with too little insurance. It covers your injuries and damages.

| Coverage Type | What It Covers | Why It Matters |

| Uninsured Motorist Bodily Injury | Medical costs for injuries caused by uninsured drivers | Protects your health and finances |

| Uninsured Motorist Property Damage | Repairs or replacement for your car damages | Helps fix your car if the other driver cannot pay |

| Underinsured Motorist Coverage | Additional coverage if the other driver’s insurance is too low | Covers gaps in the other driver’s insurance limits |

Factors Affecting Coverage Limits

Full coverage car insurance includes different elements. It often combines liability, collision, and comprehensive coverages. Various factors affect how much coverage you might need.

Your coverage limits depend on personal choices and state regulations. Understanding these can help you select the right coverage.

State Requirements

Each state has its own rules for car insurance. These rules dictate minimum coverage limits. You must meet these limits to drive legally.

- Liability coverage is often required by law.

- Some states need uninsured motorist coverage.

- Personal injury protection may be mandatory in some regions.

Personal Preferences

Beyond state rules, your choices affect coverage. You may want more protection for peace of mind. Personal preferences play a role in deciding coverage limits.

| Preference | Coverage Type |

| High asset protection | Higher liability limits |

| New car | Collision and comprehensive |

| Frequent travel | Roadside assistance |

Cost Considerations

Full coverage car insurance includes liability, collision, and comprehensive coverage. It protects you from various risks. Costs can vary based on many factors.

Understanding what influences the cost helps you make informed decisions. Let’s explore these cost considerations.

Premium Influencers

Several factors affect your full coverage premium. Knowing these can help you manage costs better.

- Age and driving experience influence premiums significantly.

- Type of car affects insurance rates. Sports cars cost more.

- Location impacts rates. Urban areas are usually more expensive.

- Driving record plays a big role. Accidents raise costs.

- Credit score can affect your insurance rates too.

Ways To Save On Full Coverage

Saving on full coverage insurance is possible. Implementing these strategies can reduce your premiums.

- Shop around and compare quotes from different insurers.

- Increase your deductible to lower your premium.

- Bundle policies, like home and auto, for discounts.

- Maintain a clean driving record for better rates.

- Ask about discounts for safety features or low mileage.

When Full Coverage Makes Sense

Full coverage car insurance protects your vehicle in many situations. It covers damage from accidents, theft, and natural events.

This type of insurance costs more than basic policies. It makes sense to get full coverage in certain cases.

New Vs. Older Vehicles

New cars are expensive to repair or replace. Full coverage helps protect your investment in a new vehicle.

Older cars lose value over time. Sometimes, full coverage costs more than the car is worth.

- Full coverage is good for cars under 5 years old

- Consider dropping full coverage for cars worth less than $3,000

- Check repair costs before choosing full coverage for older cars

Financed And Leased Cars

When you finance or lease a car, the lender often requires full coverage. This protects their financial interest in your vehicle.

Full coverage helps cover damage or loss until you pay off the car or return it. Without it, you may face extra costs.

- Financed cars usually need full coverage until paid off

- Leased cars require full coverage during the lease term

- Check your loan or lease agreement for insurance rules

Common Exclusions To Note

Full coverage car insurance offers broad protection. It covers many types of damage and losses. Still, some things are not covered by this insurance.

Knowing what is excluded helps you avoid surprises. Read your policy carefully to understand limits and exceptions.

Wear And Tear

Insurance does not cover damage from regular use. Wear and tear means parts getting old or breaking over time. This damage happens naturally and is not sudden.

Examples of wear and tear include tire wear, brake wear, and engine aging. These costs are your responsibility to fix or replace.

- Tires losing tread

- Brake pads wearing out

- Battery losing charge

- Paint fading or chipping

- Engine parts wearing down

Intentional Damage

Insurance does not pay for damage you cause on purpose. If you harm your car intentionally, your claim will be denied. This rule helps prevent fraud and abuse.

Intentional damage includes vandalism you do yourself or damage during illegal acts. Always follow the law and take care of your vehicle.

- Scratching or denting your car on purpose

- Damaging your car in a fight

- Using your car for illegal activities

- Setting fire to your vehicle

Credit: www.policygenius.com

Frequently Asked Questions

What Does Full Coverage Car Insurance Include?

Full coverage car insurance includes liability, collision, and comprehensive coverage. It protects against accidents, theft, and damage. This combination offers broad financial protection for drivers.

Is Full Coverage Car Insurance Required By Law?

No, full coverage car insurance is not legally required. However, lenders often demand it for financed vehicles. It ensures your car is protected beyond basic liability.

How Does Full Coverage Insurance Differ From Liability?

Full coverage protects your car and others, while liability covers only others’ damages. Full coverage offers broader protection, including your vehicle’s repairs.

Does Full Coverage Cover Theft And Natural Disasters?

Yes, comprehensive coverage within full coverage protects against theft, vandalism, and natural disasters. It covers damages not caused by collisions.

Conclusion

Full coverage car insurance protects you from many risks. It covers damage to your car and others’. It also helps with theft and accidents. This type of insurance gives peace of mind on the road. Costs may be higher than basic insurance, but coverage is wider.

Always check what your policy includes before buying. Knowing your coverage helps you stay safe and prepared. Choose the plan that fits your needs best. Drive confidently with full coverage protecting you.