Have you ever wondered what happens if you rent a car and get into an accident? Does your regular car insurance protect you, or will you end up paying out of pocket?

Understanding whether your car insurance covers rental cars can save you from unexpected costs and stress. Keep reading to find out exactly what’s covered, what isn’t, and how you can make sure you’re fully protected the next time you hit the road with a rental.

Don’t leave your wallet vulnerable—know your coverage inside out.

Credit: www.freeadvice.com

Car Insurance And Rental Coverage

Many people wonder if their car insurance covers rental cars. This depends on your personal policy and the rental terms. Knowing your coverage can save money and avoid surprises.

This guide explains how personal insurance extends to rentals and what limits to watch. Read on to understand your protection better.

How Personal Insurance Extends To Rentals

Your personal car insurance often covers rental cars. It usually applies when you rent a car for a short time. This coverage can include liability, collision, and comprehensive protection.

- Liability coverage protects others if you cause damage or injury.

- Collision coverage pays for damage to the rental car after a crash.

- Comprehensive coverage covers theft, vandalism, and natural disasters.

- Some policies cover rentals only in your home country.

- Coverage limits match those on your personal policy.

Limits And Conditions To Watch

Not all car insurance policies cover every rental situation. Some have restrictions and limits you must know. Check your policy details before renting.

| Limit or Condition | Description |

| Geographic Limits | Coverage may not apply outside your home country. |

| Rental Period | Some policies only cover rentals up to 30 days. |

| Vehicle Type | Luxury or specialty cars might not be covered. |

| Driver Restrictions | Only the insured driver may be covered. |

| Deductibles | You may pay a deductible before coverage starts. |

Credit Card Rental Coverage

Many credit cards offer rental car insurance as a benefit. This coverage can help protect you when you rent a car.

The insurance usually covers damage or theft of the rental vehicle. It may reduce the need for extra insurance from the rental company.

Coverage Benefits From Credit Cards

Credit card rental coverage often includes collision damage and theft protection. It can save you money on rental insurance fees.

Some cards cover towing and loss of use fees. The coverage is usually secondary to your personal car insurance.

- Covers damage or theft of rental car

- May include towing and loss of use fees

- Usually secondary coverage to your car insurance

- Can reduce or eliminate rental company insurance costs

Activation And Claim Process

To activate credit card rental coverage, you must pay for the rental fully with your card. Some cards require you to decline the rental company’s insurance.

If damage occurs, notify the credit card company right away. Keep all rental documents and damage reports for your claim.

- Pay rental with your credit card

- Decline rental company insurance if needed

- Report damage or theft quickly to your card issuer

- Save all rental and damage paperwork

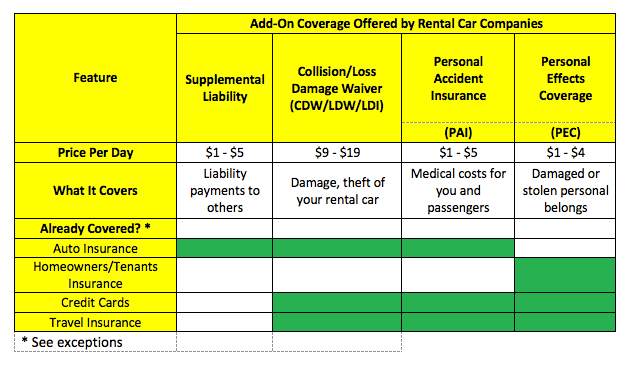

Rental Car Insurance Options

Renting a car means you need to think about insurance. Your own car insurance may or may not cover rental cars. It is important to understand what options you have.

This guide explains common rental car insurance types. Knowing them helps you choose the right coverage for your trip.

Collision Damage Waiver Explained

The Collision Damage Waiver (CDW) is often offered by rental companies. It covers damage to the rental car from crashes or accidents. CDW is not exactly insurance but a waiver of financial responsibility.

- CDW usually covers repair costs for damage to the rental car.

- It may exclude damage from reckless driving or off-road use.

- Some CDWs cover theft, others do not.

- Check if there is a deductible you must pay.

- You can buy CDW at the rental desk or beforehand online.

Liability Insurance For Rentals

Liability insurance pays for damage or injury you cause to others. It is required by law in most places. Rental cars often come with basic liability coverage.

| Type | What It Covers | Notes |

| Basic Liability | Injuries and damage to others | Usually included in rental price |

| Supplemental Liability | Higher coverage limits | Optional, extra cost |

| Personal Liability | Legal costs if sued | May be separate policy |

When Your Insurance Might Not Apply

Your regular car insurance may not cover every rental car situation. Some rules limit where and what kind of rental cars get coverage.

Understanding these limits helps avoid surprises if an accident happens while renting.

International Rental Restrictions

Many car insurance policies only cover rentals inside your home country. Renting a car abroad might not be protected.

- Most U.S. policies exclude coverage outside the U.S. and Canada.

- Some insurers require you to buy extra coverage for international rentals.

- Check with your insurer before renting in another country.

- Credit card rental coverage may differ for international rentals.

Luxury And Exotic Car Limits

Insurance often excludes luxury or exotic cars from rental coverage. These cars carry higher risks and costs.

| Car Type | Typical Coverage |

| Standard Rental Cars | Usually Covered |

| Luxury Cars (e.g., BMW, Mercedes) | Often Excluded |

| Exotic Cars (e.g., Lamborghini, Ferrari) | Usually Excluded |

| Specialty Vehicles | Check Policy Details |

Tips For Choosing Rental Coverage

Choosing the right rental coverage can save you money and stress. It is important to know what your car insurance covers before renting a vehicle.

This guide helps you understand how to compare costs and benefits. It also shows why reading the fine print matters.

Comparing Costs And Benefits

Rental coverage costs vary a lot. Some options cover damage, theft, and liability. Others only cover some risks.

- Check if your personal car insurance covers rental cars.

- Compare prices of rental company insurance and your own policy.

- Look for coverage limits and deductibles.

- Consider if you need extra protection for accidents or theft.

- Review if your credit card offers rental insurance benefits.

Reading The Fine Print

Insurance documents have important details in small print. It is key to understand what is and isn’t covered.

| Term | Meaning | Why It Matters |

| Liability Coverage | Covers damage to others | Protects you from costly claims |

| Collision Coverage | Covers damage to rental car | Reduces repair costs you pay |

| Deductible | Amount you pay before insurance | Lower deductible means higher cost |

| Exclusions | What insurance does not cover | Know these to avoid surprises |

Credit: www.banks.com

Credit: www.factionglobal.com

Frequently Asked Questions

Does My Car Insurance Cover Rental Cars Automatically?

Most personal car insurance policies include rental car coverage. This typically applies if you rent a car similar to your insured vehicle. Coverage usually includes liability, collision, and comprehensive protection. Always verify your policy details to confirm what is covered and any limitations.

Will My Insurance Pay For Rental Car Damage?

Yes, if your policy includes collision and comprehensive coverage. It covers damages to the rental vehicle caused by accidents or other covered events. Check for any deductibles and confirm if coverage applies to rental cars in your policy documents.

Do I Need Extra Insurance From Rental Companies?

Not always. If your personal car insurance covers rentals, additional rental insurance may be unnecessary. However, consider rental company insurance if your policy has limited coverage or high deductibles. Review your insurance policy before declining rental company offers.

Are Liability Claims Covered On Rental Cars?

Liability coverage usually extends to rental cars under your personal auto insurance. It covers damages or injuries you cause to others while driving the rental. Confirm your policy’s liability limits and rental car coverage specifics for full protection.

Conclusion

Car insurance may or may not cover rental cars. It depends on your policy and the situation. Always check your insurance details before renting a car. Consider extra rental coverage if your policy is limited. This helps avoid surprises and extra costs later.

Knowing your coverage brings peace of mind on the road. Stay safe and drive smart.